- The Meaning of Critical Thinking: A Key Skill for Navigating Today’s Information Landscape - November 3, 2025

- Grandparents Can Develop Activist Grandchildren - September 29, 2025

- Top Six Reasons Credit Union Benefits Are a Smart Choice Over Banks - August 18, 2025

Credit union benefits beat banks hands down. Learn how credit union benefits can help you achieve your goals.

Credit unions have transformed since the Federal Credit Union Act was signed in 1934. Now they offer financial services so similar to banks that, on the surface, it is hard to tell the difference between them. Although a credit union and a bank sitting side by side may look the same, the distinctions are huge. If you want lower loan rates, higher investment yield, and a chance to weigh in on how your money is managed, the credit union benefits are clear.

My Credit Union

I have been a volunteer Board member for almost three decades and have seen many transformations. We expanded our charter to serve community members. We created specialized loan repayment processes during the Great Recession to help people keep their homes. During the pandemic, we did the same. We offer Fresh Start loans for people with an uneven financial track record. They can get a car and improve their credit score, moving into more traditional loans with better rates.

The employees who, in 1936, put their cash in a cigar box because they wanted something better than a bank wouldn’t recognize the way ATFCU looks now. Still, they would see that the mission of helping people hasn’t changed.

Top Six Reasons Credit Unions Are a Smart Choice Over Banks

Here is a rundown of six key reasons credit unions are a smart choice.

1. Credit Unions are Cooperatives that Help People and Give Them a Voice

Credit unions are part of a broader movement called cooperatives, or “co-ops” for short. A cooperative is owned and governed by people who use its services rather than investors. At the heart of every co-op is a simple idea: people coming together to meet a shared need, pooling resources, and sharing in the outcomes. Instead of maximizing profit, cooperatives maximize value for their members and communities.

At credit unions, every member is a co-owner, with a vote and a voice, no matter how much money they have on deposit. You have a say in how things are run. The cooperative structure is people-centered and community-rooted. Credit unions do not answer to Wall Street. They answer to you.

A side-by-side snapshot of credit unions vs. banks

| Credit Unions | Banks | |

| Ownership | Owned by members | Owned by shareholders |

| Purpose | Serve members and communities | Maximize profit for investors |

| Profits | Returned to members through better rates, lower fees, and services | Distributed to shareholders as dividends |

| Decision-Making | Members vote for their directors | Your power is based on owning bank shares |

| Local Focus | Invests in local people and projects | Often prioritizes national or global returns |

| Accountability | To the members | To the shareholders (who may not use the bank) |

2. Credit Union Benefits: Lower Loan Rates and Higher Savings Returns

Credit union loans have lower interest rates, which means real savings. For example, credit union members save hundreds to thousands of dollars yearly compared to bank customers in loan interest and fees.

Credit unions typically offer checking accounts with no monthly maintenance fees, lower overdraft charges, and free ATM access. Nearly half of banks charge a monthly checking account fee.

If you are self-employed or rebuilding your credit, credit unions may be more flexible in lending decisions. They often take the time to consider your whole financial picture when approving loans.

3. Credit Unions are Convenient

Credit unions offer the tools and services you expect from a financial institution. That includes mobile apps, online bill pay, mortgage lending, and investment options. And through shared branching networks (because credit unions cooperate with one another), you can access your account at thousands of credit unions nationwide.

4. Credit Unions are Safer Than Banks

I recently represented our credit union at the World Credit Union Conference. My favorite quote:

“Credit Unions are the most trusted financial institutions on Earth.”

The head of the international regulators’ association spoke about how credit unions are much lower risk than banks. And credit unions offer the same type of deposit share insurance as banks. Banks may create take more risks at the behest of their shareholders, while credit union directors keep their members in mind.

5. Credit Unions Offer Personalized Service

At many credit unions, when you walk in the door, someone knows your name. The staff often live in the same neighborhoods and care about the community like you do. Credit unions consistently score higher than banks in customer satisfaction.

This personalized service results from the cooperative model, where staff work for you. But a side effect of the cooperative model is that they are a great place to work. The Board and the credit union President know that happy staff provide better service to members. At our credit union, we strive to be an “employer of choice” in our area, offering expanded benefits over those offered to bank employees.

Credit Unions Care About Your Financial Well–being

Credit unions tend to offer more robust help when you are trying to build credit, pay off debt, or understand your financial picture. Workshops, counseling, and tools are often free and part of their mission. In fact, credit union members are more likely to have access to financial education than bank customers.

Credit Unions Provide Lending Solutions

Only one in five households in Hawaii can afford a home, and mandatory cesspool upgrades cost $40,000–$50,000. So, the credit union stepped in with tailored solutions: a cesspool‑conversion loan that advances full funding upfront and lets homeowners pay it back later once public grants are applied. They also offer down‑payment assistance programs.

This is the kind of community‑focused lending you will see at credit unions across the United States. And at the World Council of Credit Unions, I got the global perspective on how credit unions help their members. One speaker was from the war-torn part of Ukraine and spoke about how they provided initiatives to soldiers and their family members. A speaker from Brazil talked about the vital role of credit unions in their widespread country, where banks are leaving rural areas and credit unions are often the only financial option. One fascinating story was about the cheesemaking industry in rural Brazil. The government outlawed cheesemaking, which devastated the community. The credit union staff lobbied the government to rescind the law and allow the community to start selling cheese again. They also provided the farmers with loans to diversify their operations.

6. Credit Unions Invest in Your Community

Credit unions do not just operate in communities; they support them. When you join a credit union, your deposits fund local mortgages, car loans, and small business growth. Your money supports you and your neighbors.

Credit unions strengthen local economies and help reduce financial inequality. Many offer specialized credit union loans for small business startups, home energy improvements, or emergency relief.

In the United States, banks continuously lobby the government to remove the credit union’s tax exemption. Fortunately, lawmakers see the difference between banks and credit unions.

“Credit unions are providing basic financial services for the millions of Americans who are left behind by banks that are closing branches and creating banking deserts. Serving rural America and inner cities is not profitable. Over the past 13 years, banks have closed over 20,000 branches across the country. In comparison, credit unions have added hundreds of branches during that time, rushing in to fill the void and serve American communities left by banks” – America’s Credit Unions

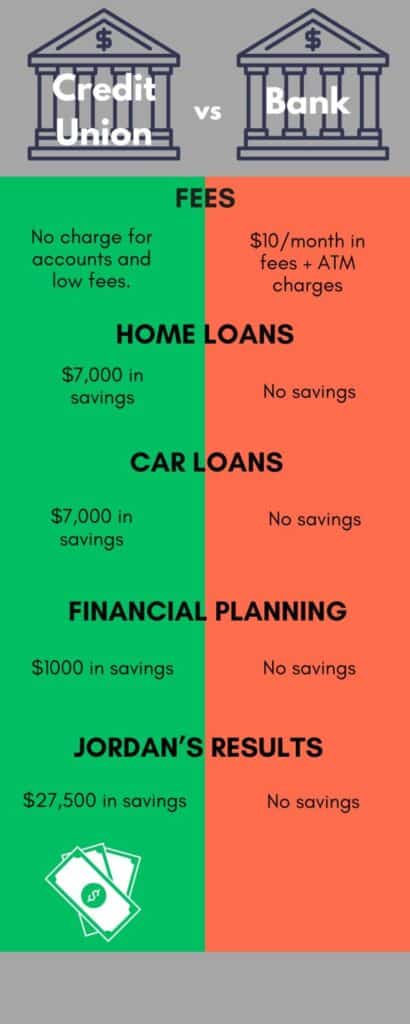

Meet Jordan: A 24-Year-Old Who Chose a Credit Union Over a Bank and Ensured Financial Well-Being

Over the next few decades, that decision made a big difference.

Jordan Opens Accounts

- Jordan’s Credit Union: No monthly fees, free ATM access, and a slightly higher interest rate on savings.

- Bank Alternative: $10/month in fees + ATM charges.

- Estimated 10-year savings: ~$1,750

Jordan Gets Married and Starts a Family

Over the years, Jordan finances three reliable vehicles using credit union loans with better-than-bank rates.

- Average auto loan savings: About 1.5% lower interest rate at credit unions

- Loan amount: ~$25,000 per car

- Total estimated interest savings: ~$2,000–$2,700 per loan

- Three loans = ~$7,000 in savings

Jordan Buys Two Homes

Jordan buys a starter home when he marries Molly. Later, after three kids, they move into a larger one. Both mortgages are through the credit union.

- Average mortgage rate savings: 0.125%–0.25% lower (depending on lender and year)

- Mortgage amount: ~$250,000 each

- Estimated lifetime interest savings per mortgage: $10,000

- Two mortgages = $20,000 in savings

Jordan Plans for Retirement

Jordan takes advantage of free retirement counseling through the credit union. He gets help creating a savings plan, choosing an IRA, and understanding Social Security options.

- Cost at a bank or private firm: Often $1,000+ for comparable retirement planning

- Estimated savings: $1,000, plus potentially better returns on his investment

Jordan’s Bottom Line

By choosing a credit union at age 24, Jordan got the same services as a bank but saved almost $30,000. Beyond the numbers, Jordan received personalized service and supported a cooperative that benefited others and his community.

Ready to see the difference for yourself?

It is easy to get overwhelmed when you are making big financial decisions. But what if you were a member of a financial organization that took the time to help you?

Credit unions might not be the sexiest of financial institutions. Instead, they are steady, safe, people-focused cooperatives that quietly make a big difference.

Your money matters. So does where you keep it.

Visit your local credit union. Find credit unions near you. Walk in, ask questions, and see how they treat you. You do not have to switch overnight. Start learning what is available to help you make smarter choices with your money.

READ NEXT

What Is a Credit Union and How Can It Help Me?

Four Ways to Be a Savvy Consumer